How super investment option fees vary

Superannuation members who have selected an investment option other than their fund’s balanced option may be paying more in fees than they realise, according to research by Rainmaker.

The Researcher said investment management fees generally account for around half of the total fees paid by members.

However this is based on the average member who remains in the default investment option (around 40%) there is a range of members who elect to choose their own option, and for these members, the investment management fees vary significantly.

A review of the option specific fees across 30,000 individual investment option within Rainmaker superannuation database shows fees varied significantly by asset sector and by type of fund. the analysis also shows the fees for selected options were significantly higher than the fees for the default investment options within workplace funds.

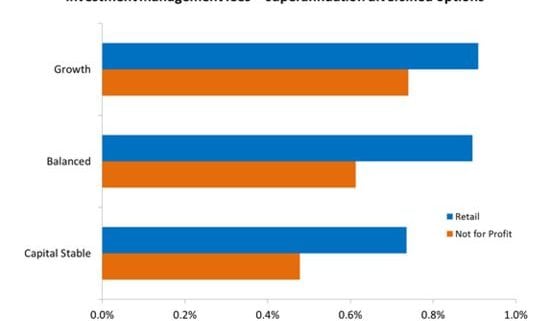

The average investment management fee for workplace super is currently at 0.62%. However, once you step out of the MySuper default options, the comparative investment fee increases meaningfully.

The average fee for a diversified option is 0.84%, over 20 bps above the fee for the workplace default option.

Growth diversified options carry a slightly higher average of 0.87%.

The price of diversified options for retail superannuation funds is on average around 25 bps above diversified options for not-for-profit superannuation funds.

The range of investment fees is wider in respect to asset specific options. While cash and fixed interest options are, on average, below 0.5%, the average fees for equity options are 1.1%. Above these, options for alternative and hedged assets average 1.2% and 1.9% respectively.

[via FINANCIAL STANDARD]