Value of advice still unclear: IOOF

Australians are still dissuaded by the cost of seeking financial advice, despite those that receive financial advice being 21% more likely to have greater peace of mind.

IOOF believes the benefits of advice must outweigh the cost in order for clients to value it with not everyone needing it to produce tangible financial benefits.

“Simply put, clients value advice provided it meets a particular need. . . For some, value comes from those intangible benefits, such as sleeping better at night, while for others value lies in the more tangible benefits, such as tax minimisation, above average returns or low fees,” IOOF group general manager, wealth management Renato Mota said.

Mota believes financial planners need to demonstrate their value more when it comes to fee discussions and allow clients to determine what constitutes ‘value’.

“rather than leading with the vague and intangible term ‘value, when the vague and intangible term ‘value’ when discussing fees, it will be more useful to provide the full list of services you offer and clearly show why your fees are a fair reflection of those services,” Mota said.

“If you include intangible benefits of advice, such as counseling against destructive client behavior, as part of your conversation with clients, it’s important to be specific on how this is a service which adds value to their portfolio.”

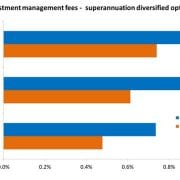

Mota reinforced the undeniable appeal of low fees too, saying it’s inevitable that some clients will view cost as the yardstick of value and there are simple ways to reduce fees.

IOOF encourages planner to consider improved passive investments delivering returns above traditional benchmark indices at a lower cost. It also highlights fee aggregation as a great way for clients to limit the number of administration fees paid.

“As investors become more cautious about their spending, having a clear link between fees charged and the service which provides value will become more important. For some clients finding a way to offer lower fees will be crucial, but it should be remembered – cheaper financial advice doesn’t make it better, it’s just cheaper.” Mota said.

[via FINANCIAL STANDARD]