OneAnswer Frontier caps off an award winning year

/in Superannuation /by Always FinancialOneAnswer Frontier kicked off 2015 by taking out the SelectingSuper Personal Super Product of the Year — Premium Choice Award, and the Innovation — Product Development Award.

OneAnswer Frontier was specifically chosen for its market-leading product functionality, simplicity and range of investment and insurance solutions, at fees well below many of its peers.

And the accolades continued, with OneAnswer Frontier Pension winning the CANSTAR ‘Outstanding Value’ award for Account-based pensions and a SuperRatings Pension of the Year 2016 Finalist award.

Local equities down but so are the others

/in Australian equities, Financial /by Always FinancialThe Australian equity market suffered its worst third quarter this year since the same quarter in 2011.

The All Ordinaries index dropped by 7.2% in the September quarter, taking its overall performance down 6.1% in the first nine months of 2015. Below-trend growth in the domestic economy or more worryingly, predictions of a recession — and its nasty consequences for corporate profits — has soured investor appetite for the local bourse.

“[The risk of recession] currently stands at the greatest probability since the global financial crisis”, the Sydney Morning Herald printed on 11 September quoting GS chief economist Tim Toohey.

This was quickly followed by Kima Capital’s warning that, “Australia is destined for a difficult recession at worst or a prolonged period of well-below-trend growth at best” again printed in the SMH less than three weeks later.

With such dire predictions, the Australian equity market’s negative return so far this year is hardly surprising.

However, the local bourse is caught in the same headwinds that are buffeting all other quity markets worldwide. THe All Ord’s minus 6.1% return is less than a percent lower than the negative 5.4% from developed market equities and better than the negative 9% return from emerging market equities over the same period.

To be sure, this would not prevent the Australian economy from succumbing to a recession but recent economic data and survey updates indicate it’s improving. — resilient, at worst — despite the on-going slow growth in the global economy and slowdown in emerging economies.

For instance, the latest NAB business survey shows confidence reviving to a plus 5 reading in September from plus 1 in the previous month. While the change in leadership from Abbott to Turnbull could have boosted confidence, remember that September was not a particularly good month due to heightened financial market volatility that culminated in the worst September quarter for equities since the third quarter of 2011.

This gives credence to NAB’s assessment that, “Overall, the business survey suggests a good degree of resilience in what appears to be a building non-mining sector recovery.” More so given the business conditions index remains elevated at a plus 9 reading, unchanged from August but up from the plus 6 reading in July.

Consumer confidence has also recovered. The Westpac/Melbourne Institute index of consumer sentiment rose by 4.2% to 97.8 in October from 93.9 in September. While still below 100 (optimists outnumber pessimists), the components of the index showed sharp improvements: Economic conditions expectations soared by 20% over the month, unemployment expectations dropped by 16.3% and expectations for family finances increased by 3.5%.

[via Financial Standard]

NAB sells MLC risk business

/in Financial /by Always FinancialNational Australia Bank (NAB) has sold 80% of its MLC life insurance business to Japanese insurer Nippon Life for $2.4 billion.

NAB will retain ownership of its superannuation, platforms, advice and asset management businesses.

It will also retain the MLC brand, although it will be licensed for use by the life insurance business for 10 years.

The buyout is expected to be completed by the second half of 2016, although it is subject to certain conditions, including regulatory approval and the establishment of the MLC insurance business as a standalone entity.

This entails the extraction of the superannuation, advice, asset management and platforms businesses from the current structure.

“This partnership will enable us to continue to deliver insurance solutions to our customers while improving wealth returns for shareholders,” NAB Group chief executive Andrew Thorburn said.

Plan for Life report of life insurance premium inflows and sales for the year to June 2015 shows that MLC had 12.1% market share of premium, 1% down from June 2013.

MLC is Australia’s fifth largest insurer by market share (12.1%) and is behind TAL, AIA, AMP and CommInsure.

Rainmaker research shows that MLC is not among Australia’s top insurers in the superannuation space by members served.

MLC is ninth in the list of top superannuation insurers and it serves less than one million members, most of which are from retail funds.

The list is topped by AIA and followed by TAL, OnePath, CommInsure and AMP.

As part of the bank’s annual results, Thorburn announced a $300 million investment in NAB Wealth over the next four years.

“This will allow us to deliver a great customer experience while driving a closer relationship between our banking and wealth businesses,” Thorburn said.

During the year to September 30, 2015, NAB Wealth’s cash earnings increased 27% to $464 million and net income rose 10%, reflecting higher insurance premium pricing, improved insurance lapses and claims, and non-recurrence of insurance reserve strengthening in the previous year.

Funds under management rose 8%, with strong investment markets and the acquisition of Orchard Street Investment Management in the March 2015 half year.

This increase was offset by lower investment earnings on retained earnings and lower investment margins due to MySuper transitions.

[via Financial Standard]

Interest rates, the yield curve and investing

/in Australian equities, Financial, Investment /by Always FinancialOn the face of it yield curves tell us what interest rates are. They merely represent, after all, the term structure of yields at a given moment of time. But look behind the curtain and they tell a dramatic story of huge forces at work, all the while shaping the investment landscape in new and unusual ways.

With all the media focus on daily moves in sharemarkets or whether reserve banks are about to raise or lower cash rates it is easy to lose sight of the things that speak loudest and clearest. Understanding interest rates and the yield curve is crucial to creating logical and effective investment strategies, yet they remain one of the most misunderstood of investment concepts.

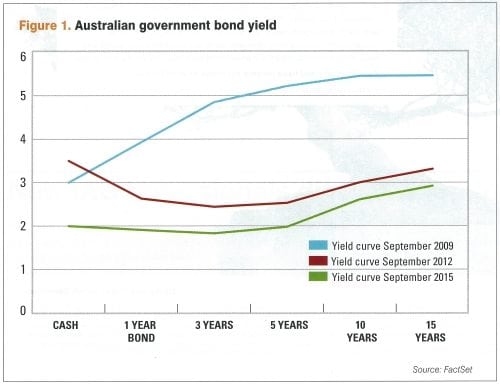

By taking snapshots of the Australian yield curve at different points in time over the past six years we illustrate the different investment environments we have been through and anticipate those to come.

Yield is the income earned for a given price. It is the same concept whether the asset is cash, a fixed coupon bond, equities or property. The yield is meant to compensate the investor for the risk of holding the asset. Therefore, the more risky the asset, the higher the yield should be. The yield curve is the line that plots the interest rates at a point in time of bonds having equal credit quality but different maturity dates. Normally, they are upwards sloping, with cash having the lowest yield and long dated bonds the highest. Cash returns the least because there is no risk of capital loss (although there is a risk of real capital loss, once inflation is taken into account) and it is the definition of liquidity.

Cash is also directly set by the central bank in the service of its economic objectives, such as price stability or economic growth. Longer dated bonds are more risky because their price is more volatile. They may pay a regular guaranteed coupon but the longer they have to go before maturity the more risk there is that things can go wrong. Interest rates generally might rise, meaning that the capital value of the bond will fall. The longer dated it is, the more it would fall. If interest rates fall, the price of the bond will rise. Investors want to be compensated for this uncertainty.

But yield curves in the real world are not all upwards sloping. They come in all shapes and sizes, and they tell a fascinating story. In this story we look at three Australian yield curves, three years apart and see what they tell us about the investment landscape at the time, and of the future.

The following chart shows an upwards sloping yield curve from September 2009. It signals that things are good economically and expectations for the future are high. The cash rate was 3%. The Reserve Bank had been cutting rates from a peak of 7.25% one year before. The stock market was in the midst of a bull run that had just seen it rise 46% int he previous seven months and still had a long way to go. The economy was robust and commodity prices were high. Oil was US$65 a barrel and iron ore was US$80 a metric tonne, up from US$38 five years previously, and the Australian dollar was on the rise, buying US$0.88 at the time.

Fast forward three years to 2012 and the yield curve looks completely different. So does the world. In the intervening period the Reserve Bank has increased cash rates to as high as 4.75% in an effort to slow growth and then started reducing rates to 3.5%. The yield on a 15 year government bond has dropped more than two percentage points from 5.5% to 3.3% indicating growth for the future looks subdued. The yield curve is now inverted and negative. The fact that cash rate is higher than longer term government bonds is extremely worrying and clearly signals that the Reserve Bank will continue to cut short term interest rates.

Meanwhile the Australian Dollar has already reached its peak against the US Dollar of US$1.10 but is still worth US$1.04, 18% higher than three years previously. Crude oil has risen 70% in three years and is worth US$112 a barrel. Iron ore, meanwhile, is US$100 a tonne, down around one third in four short months but still massively higher than the long run average.

The Australian sharemarket had risen 10% in four months, and as interest rates are lowered, is about to go on a tear and add about 24% in the next 12 months.

Fast forward again to the end of September 2015. Economic prospects for the country are much more subdued, the sharemarket is down around 13% from its 2015 peak — nearly all of this in the previous two savage months. The cash rate is sitting at 2%, as it has done for five previous months, and doesn’t look like going anywhere except down for the foreseeable future. There doesn’t appear to be much risk of recession, but not a lot of economic growth in the medium future either. The iron ore price has collapsed to US$57 a metric tonne, but remains volatile. The Australian Dollar is now buying US$0.70. The yield curve has had a huge parallel shift down. It’s flat for five years and then slightly positive from 10 to 15 years. The one and three year rates are lower than cash, indicating that expectations for economic growth are very low.

[via Financial Standard]

Mandate tide turns towards global equities

/in Australian equities, Financial /by Always FinancialInstitutional investors are moving fast to protect their portfolios from the risks facing the Australian market. Over a third of the money poured into new mandates last year was in international equities, twice the amount of new funds invested in Australian equities.

The latest edition of the Rainmaker Research Mandate Chaser report shows that Australian institutional investors awarded about $29 billion in mandates during the year to June 2015. As much as 34% of these funds went into international equities mandates, while about 18% was invested in Australian equities. Alternatives, another rising trend, accounted for about 22% of new mandates.

This represents a sharp change compared to previous years. New institutional money invested in Australian equities has been consistently falling over the last few years, with the sharpest fall registered between June 2014 and June 2015.

“We are having a number of [institutional] clients reweighting away from Australian equities and into international equities,” Hyperion managing director Tim Samway said.

The Australian equities manager is close to reaching capacity and closed its institutional business to new inflows last April. At the same time, the Hyperion team is researching international stocks and managing an internal portfolio with the aim of building and launching a global equities product in the future.

The increase in international equities mandates is significant in the context an overall fall in the number of new mandates. Rainmaker Research shows that institutional investors awarded 287 new mandates in 2015, fewer than the 385 awarded in 2014 or the 664 in 2011.

“The mandates that we win have been stickier,” Samway explained. “We have a number of investors that have been with us for around 10 years or even more.” He added that this reflects superannuation funds’ increasing focus on long term objectives, but also awareness that appointing new managers can be costly.

“Super funds are getting a large exposure of their portfolios to passive strategies and they come to active managers and boutiques looking for alpha,” he said.

REST chief executive Damian Hill explained: “We don’t turn over managers that much and we try not to have too many managers. We don’t mind that much the size of the initial mandate, but the capacity to grow it in the future.”

Hill confirmed that the trend for in-housing could also be having an impact. “Of the latest four or five new mandates, two or three have been to our internal team,” he said. However, he highlighted that as the industry matures and more superannuation members move towards retirement, net flows are going to be lower. “This will make funds more circumspect about what they do. They will have to pay more attention to their cashflow as payments and superannuation benefits increase.”

UBS Asset Management is among the top 10 managers to receive more mandate inflows over the last three years. Head of Australia and New Zealand Bryce Doherty said that a reason behind the decrease in new mandates is that funds are bringing the management of traditional asset classes in-house and look elsewhere for more sophisticated strategies.

“Funds are moving away from the idea that they need to have large, broad portfolios.” Instead, they demand multi-asset strategies and solutions that can be tailored for the needs of each fund.

“They want good performance, but also risk management tools and economic insights from what is happening in other countries; information that they can’t get by themselves,” he said.

QIC executive director of strategy, clients and global markets, Brian Delaney, has experienced similar changes in demand. “More and more clients are looking for solutions that might not necessarily result in a product,” Delaney said.

This could also explain the decrease in the number of new mandates: “Going back, a manager would build a product and run the same thing for many clients. But now we are looking at strategies, engaging with clients about particular things they have to solve.

“The sophistication level of clients has increased and as a result they are getting quite particular about what they want to pay for,” Delaney said, adding: “In the past, some were paying active fees for beta driven asset classes. Now they are getting smarter about the questions they need to ask,” a trend that is forcing the rest of the industry to lift its game.

[via Financial Standard]

Super to fund Aussie infrastructure: Shorten

/in Financial, Superannuation /by Always Financial Federal opposition leader Bill Shorten has made it no secret he will look to Australia’s superannuation industry to unlock billions in capital investment for key infrastructure projects.

Federal opposition leader Bill Shorten has made it no secret he will look to Australia’s superannuation industry to unlock billions in capital investment for key infrastructure projects.

Unveiling Labor’s infrastructure plans at a Queensland Media Club event last night, Shorten said the predicted $4 trillion in super savings by 2025 should be put to “work on nation-building.”

The plan is to have Infrastructure Australia backed by a $10 billion funding facility that deploys equity to jumpstart new projects. In turn Infrastructure Australia “would transfer its equity or debt interests to long term investors such as super funds to maximise the return to the Commonwealth and so that capital can be recommitted to new projects.”

It is a plan that federal treasurer Scott Morrison said “has some merit.” In an interview on Melbourne radio yesterday, Morrison said productive infrastructure was one of the key things needed to grow the economy.

“Now, these are interesting ideas, any idea though is only ever going to be as good as its implementation. So, while I think there is some merit in what he [Shorten] is putting forward at the end of the day what has to happen is you have got to find projects that actually can pay a return. I mean it’s not grandfathering, they’re not just going to hand it out and give it to the states to build infrastructure,” Morrison said.

“So, the projects he has talked about aren’t made possible by this, they would have to satisfy a test to see whether they will make money and that means someone is going to have to pay a toll, someone is going to have to pay a fare.”

Shorten said in his speech that Labor will elevate Infrastructure Australia to an active participant in the infrastructure market, “mobilising private sector finance, Australia’s superannuation industry and international investors to bring a national pipeline of investment online.”

“We have a deep pool of domestic capital in superannuation as well as significant global investors that are searching for stable and reliable assets to invest funds over extended periods,” Shorten said.

Infrastructure Australia has estimated that the economic cost of underinvestment is projected to reach $53 billion a year by 2031.

[via Financial Standard]

MySuper fees force super fund to exit high return strategy

/in Superannuation /by Always Financial

The requirement to charge low fees under MySuper has forced one superannuation fund to exit a Principal Global Investments (PGI) strategy that had returned 13% over five years.

PGI chief executive in Australia Grant Foster said that the super fund pulled some of the money out of a real assets capability despite being “very happy investors.”

“They have said that because of the MySuper fee pressure they have to reduce their exposure to this real asset class, which for me is nonsense,” Foster said.

“The focus on fees here continues to press on,” he said, and added that “from our perspective it will be very interesting to see how these products perform, particularly if markets get really difficult the next couple of years. MySuper will find it a bit difficult [to deliver good performance].”

Foster said: “There’s one direct example we can point to where we know this is the cause. But we are also talking to many super funds about being in the real asset space, in the property or emerging market space.

“I don’t want to suggest that this is ramping. But as MySuper products evolve and get ready for 2017 they’re moving to passive -they’re doing it right now- and moving out of these more active options, and that’s going to continue.”

Also speaking to the media, Create Research chief executive Professor Amin Rajan warned that “there is the idea that index funds are cheap and less risky. But they are not less risky. You don’t really know what’s really moving prices there other than the psychological sentiment of investors.

“There is a health warning associated with index funds,” he said.

[via Financial Standard]

SMSFs keeping cash for better markets

/in SMSF /by Always FinancialSelf-managed superannuation funds (SMSFs) stored away $56 billion in excess cash during the 12 months to April 2015, the highest amount in seven years.

Billions that would have been invested if it were not for market uncertainty is reflective of a wider trend that saw more SMSFs adopt defensive investment strategies when making asset allocation changes over the past year.

Growth in the number of SMSFs has also been subdued over the last two year, with about 25,000 SMSFs established in the 12 months to March 2015. This is down by about 8,000 from the same period in 2013 and is the lowest annualised growth rate since the introduction of Simpler Super reforms in 2008.

The figures form part of annual SMSF research released jointly by Vanguard and Investment Trends on August 9th. This year’s report is based on a survey of about 4,000 SMSF trustees and 501 financial advisers.

Vanguard head of marketing strategy and communications, Robin Bowerman, said SMSF trustees currently have a bearish outlook and it is having an impact on the investment decisions trustees are making, and in turn their funds’ asset allocation.

“The large portion of assets that SMSFs continue to hold in direct shares, and the increasing levels of excess cash, present a range of issues for SMSF portfolios. The may be building in more concentration risk at a time when trustees are increasingly concerned about financial markets,” Bowerman said.

Investment Trends head of research wealth management, Recep III Peker, said although it looked like the SMSF growth rate had slowed, “it’s just an indication of how the share markets are going and how super funds have been performing.”

“ARPA stats show SMSF assets grew by 10% over the last year, but all other super assets grew by 16%. One of the main drivers behind that gap is that SMSF members are a lot older than the whole population in superannuation,” Peker said.

“Also it is the under exposure of international assets as well. They [SMSFs] have started to recognise this gap but what you’ll find is they’re prioritising diversification in their portfolios a lot more.”

SMSF allocations to listed and unlisted managed funds continued to increase, growing to 18% of total assets, up from 15% in the last year. The allocation to direct shares drifted down from 44% to 41% of total assets but direct shares maintained their position as the dominant asset class among self-managed funds.

The proportion of SMSFs using managed funds has continued to grow, reaching 43% in 2015, a level not seen since 2011. The number of SMSFs holding EFTs grew 53% in the 12 months to April 2015, with growth also reported in the number of SMSFs who intend to invest in EFTs in the coming year, up 20%.

— via the FINANCIAL STANDARD, Aug 15

Member engagement a danger to super savings

/in Financial, SMSF /by Always Financial

Mary Murphy — Chief digital officer, First State Super

A high level of engagement with superannuation savings can lead members to make the wrong move at the wrong time, industry executives have warned.

“The joke is that often if you’re disengaged with your super, ironically it can be good,” State Street Global Advisors (SSGA) head of Investment Solutions Group for Asia Pacific Mark Wills said.

Wills also said that the problem is “when you get to 67 you don’t tend to be disengaged.”

Quoting a study by the Association of Superannuation Funds of Australia (ASFA) on super fund member behaviour during the global financial crisis, he said “in some schemes up to 50% of members either switched or inquired about switching.”

“Education, member engagement, all of that — we think it’s a waste of time,” he said, and explained that members’ real interests are retiring and having a pension.

Behavioural finance shows that “as humans, we tend to focus on overconfidence as opposed to bad parts; and the bad part is often so visceral and so dramatic that it creates all these bad behaviours.”

He said that a key issue is “how do you get people to stay the journey and understand what their money is trying to do.”

This has become a concern in the current low return environment, where members could be switching to riskier investments in a bid to increase their returns.

“The real risk now is that we’re entering a repressed return environment and people will continue to over reach.”

First State Super chief digital officer Mary Murphy also commented on super fund member engagement and said that the super industry can “get trapped by this engagement word. Engagement is about what satisfies me as a consumer.”

— via the FINANCIAL STANDARD, Aug 14

How to solve a problem like TPD?June 15, 2017 - 4:02 pm

How to solve a problem like TPD?June 15, 2017 - 4:02 pm Platinum backs Internet stocks and Asian infrastructureJanuary 27, 2015 - 8:56 am

Platinum backs Internet stocks and Asian infrastructureJanuary 27, 2015 - 8:56 am More Australians to invest in ChinaJanuary 27, 2015 - 8:57 am

More Australians to invest in ChinaJanuary 27, 2015 - 8:57 am AMP posts 32% increase in profitFebruary 23, 2015 - 1:12 pm

AMP posts 32% increase in profitFebruary 23, 2015 - 1:12 pm Home buyers accessing super “a thoroughly bad idea”...March 23, 2015 - 1:29 pm

Home buyers accessing super “a thoroughly bad idea”...March 23, 2015 - 1:29 pm Economic growth to slow significantlyMarch 28, 2015 - 1:51 pm

Economic growth to slow significantlyMarch 28, 2015 - 1:51 pm

How to solve a problem like TPD?June 15, 2017 - 4:02 pm

How to solve a problem like TPD?June 15, 2017 - 4:02 pm ETP demand grows, fees stableJune 15, 2017 - 2:15 pm

ETP demand grows, fees stableJune 15, 2017 - 2:15 pm AMP modifies insurance offeringJune 14, 2017 - 1:20 pm

AMP modifies insurance offeringJune 14, 2017 - 1:20 pm Education key in combating elder financial abuseJune 13, 2017 - 12:51 pm

Education key in combating elder financial abuseJune 13, 2017 - 12:51 pm Value of advice still unclear: IOOFJune 12, 2017 - 11:51 am

Value of advice still unclear: IOOFJune 12, 2017 - 11:51 am Super funds return 2.9%November 28, 2016 - 11:34 am

Super funds return 2.9%November 28, 2016 - 11:34 am

Client Portal

Level 2

496 Hunter Street

Newcastle, NSW, 2300

PO Box 364

Newcastle, NSW, 2300

Financial Services & Credit Guide

Privacy Policy

ACN 101 927 413

trading as Loyalty Financial Services

ABN 93 276 492 792

Australia Financial Services License 227096